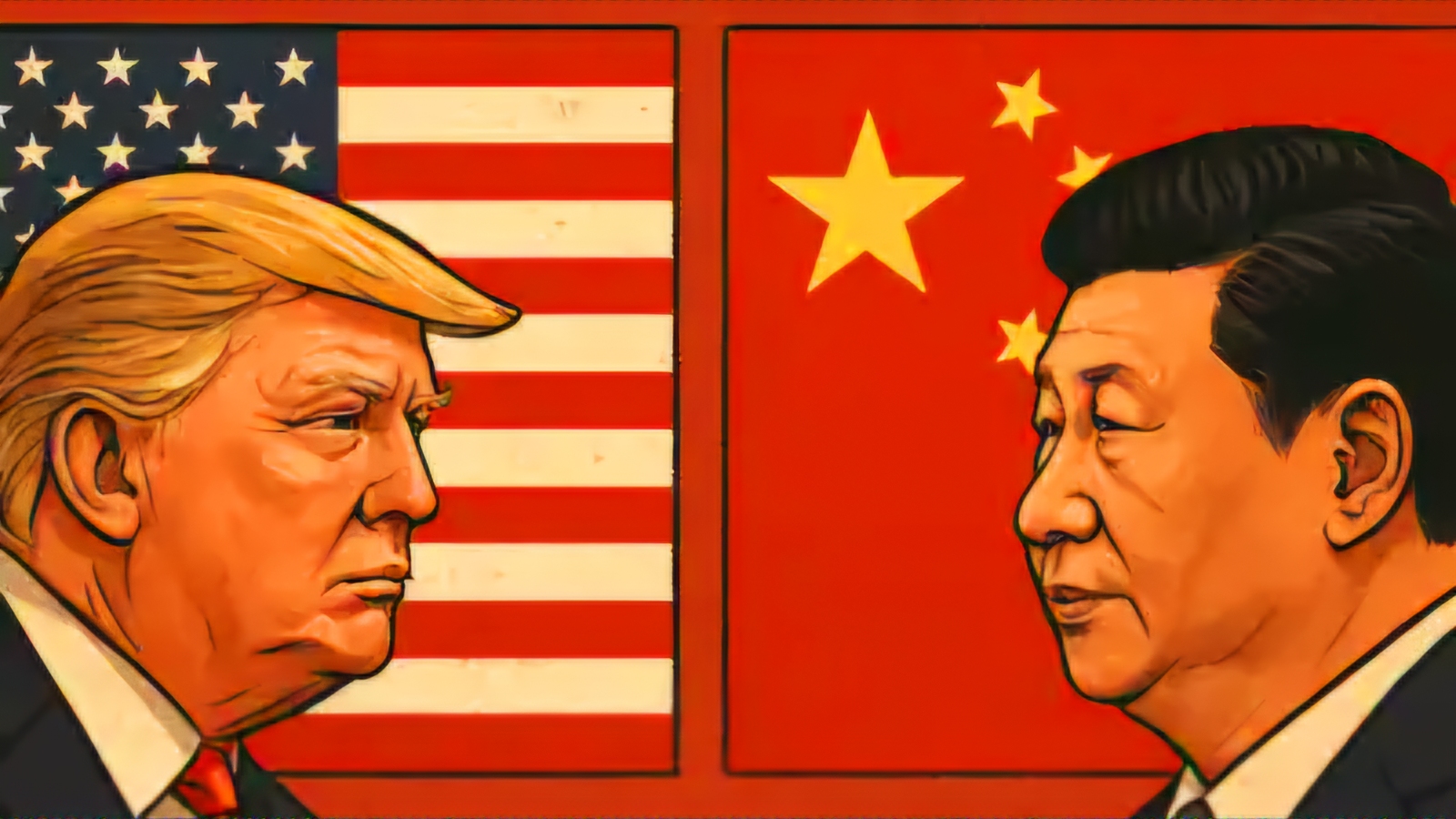

Tensions Escalate as China Responds to Trump Tariffs with a Staggering 84% Duty on American Goods

- by Mike Morris, Wall Street, RNG247

- about 9 months ago

- 206 views

Early trading opened with a sense of uncertainty today as the stock market grappled with escalating trade tensions following China's latest retaliation against U.S. tariffs. The response comes on the heels of President Trump’s decision to impose significant tariffs on a variety of Chinese imports, igniting fears of a deepening trade war between the two economic giants.

As the bell rang on Wall Street this morning, the mood was palpable. Major indices exhibited a mixed performance: the Dow Jones Industrial Average opened slightly lower, while the S&P 500 and Nasdaq Composite saw modest gains, reflecting investor caution amid the unfolding situation. Traders watched closely as stock prices fluctuated in response to the rapidly changing news cycle surrounding U.S.-China trade relations.

China's recent announcement of an eye-popping 84% tariff on certain American goods is sending shockwaves through the markets. Products affected by this steep tariff include agriculture staples, electronics, and manufactured goods that have traditionally enjoyed favorable access to the Chinese market. Industry experts and analysts are now expressing concerns over the potential for significant repercussions not only on businesses reliant on exports but also on global supply chains.

In a statement, Chinese officials emphasized that the tariffs were a necessary response to what they termed “unfair trade practices” imposed by the Trump administration. “We remain committed to achieving a fair and balanced trade agreement, but we will not sit idly by while our interests are threatened,” a spokesperson from the Chinese Ministry of Commerce stated. This bold action by Beijing reflects its determination to stand its ground in the face of unilateral trade moves by the United States.

Economists are warning of a turbulent economic landscape ahead if both countries do not come back to the negotiation table. Some predict that consumers could soon feel the impact of these tariffs, as increased costs are likely to trickle down to retail prices. Businesses reliant on exports to China are also bracing themselves for a potential decline in sales, while analysts are closely monitoring stocks in affected sectors, notably agriculture and technology.

On the political front, Trump’s team is defending the tariffs as a crucial strategy aimed at reducing the trade deficit and protecting American jobs. The administration touts its efforts as aligning with a long-term vision for economic resilience, despite the immediate fallout evident on the trading floor.

As markets remain in flux and investor sentiment hangs in the balance, the long-term consequences of this trade conflict remain uncertain. Traders are left to ponder the likelihood of forthcoming negotiations that could stabilize relations—or further escalations that could lead to a broader economic fallout.

As the day unfolds, Wall Street is bracing for a roller-coaster ride, fueled by headlines and developments emanating from both Washington and Beijing. This economic tug-of-war continues to captivate not only those on the trading floor but also the global audience watching for signs of resolution in a trade battle that has far-reaching implications.

Only time will tell whether diplomacy will prevail or whether this tit-for-tat approach will lead to an extended period of economic instability. Investors and everyday consumers alike will remain vigilant as these two powerhouse nations navigate their fraught relationship.

0 Comment(s)